|

|

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

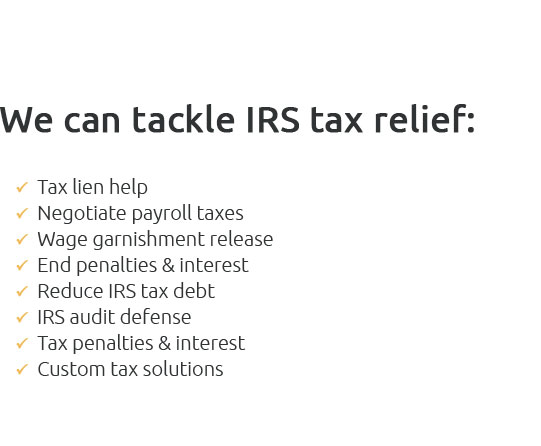

Facing the daunting weight of owing the IRS back taxes can feel like an insurmountable burden, but with our expert tax debt attorneys by your side, you don't have to navigate this overwhelming journey alone; our team specializes in crafting personalized solutions to alleviate your tax debt stress, negotiate effectively with the IRS, and empower you to reclaim financial freedom with confidence and peace of mind, because you deserve a fresh start and we are committed to making that happen.

https://www.hrblock.com/tax-center/irs/audits-and-tax-notices/owe-the-irs-back-taxes/?srsltid=AfmBOorFBRLm01ylFkOSHl0uJcGJn3pf7x2Fm5d8hE3JqW55yA8Fgjh7

The answer is yesit's important to file your return or an extension to avoid the failure to file penalty. This penalty is equal to 5% of the unpaid balance ... https://www.irs.gov/payments/offer-in-compromise

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax ... https://www.cnbc.com/select/tax-payment-plan-options/

The IRS's short-term payment plan gives taxpayers up to 180 days to settle their debt. It does carry a failure-to-pay penalty of 0.5% a month and interest will ...

|